How to Get a Home Remodel Loan?

A home remodeling loan can enable you to finance significant home upgrades, which can enhance your property's value and improve your living standards. However, before applying for one, you must first understand which type of loan is appropriate. Continue reading to learn more about financing, loan types, and, most essential, how to apply for a loan.

1: Examine Your Finances

The first step is to examine your financial condition and determine how much money you have available each month. Make a realistic monthly budget that includes all recurring monthly expenses such as mortgage payments, entertainment, credit card payments, utilities, food, savings, and other responsibilities.

Subtract that number from the amount of money you take in as a household. This difference should indicate your available money for a home improvement loan payment. You should also analyze your credit score, as it will affect the interest rates you can acquire. Lower credit scores are frequently associated with higher interest rates.

2: Understand Loan Types

Consider the following factors when determining which home improvement loan is best for you:

Credit Report

Some home renovation loan providers need a minimum credit score to be eligible.

Credit History

Your approval may be impacted if you have any previous bankruptcies, repossessions, or unpaid bills.

Home Equity

Check your home's equity to see if you qualify for remodeling loans that need a particular proportion of equity.

Limitations on Funding Use

Every home renovation loan operates differently. Some lenders demand you to utilize the funds just for renovations, while others restrict the types of work you can do.

Loan Amounts

The lender determines the maximum loan amount, which varies depending on the loan type. The loan lender's borrower criteria will determine whether or not you qualify.

Loan Fees

Any loan will have service charges, settlement costs, and prepayment penalties. However, home remodel loans frequently come with additional fees, such as the cost of a house appraisal, a title search, or a fee to record the new lien on your home.

3: Collect Your Documents

The paperwork needed will be specified in the loan application. However, there are a few rather common objects:

- Proof of residence

- Social Security number

- Government-issued photo ID

- Employer contact information

- Evidence of income via tax returns and recent pay stubs

- Contractor agreement (if asked)

4: Apply for a Loan

It is now time to start the application process. The stages vary depending on the type of loan, but in general, you may anticipate to:

- Complete the online lender's application form on the lender's website.

- Provide all required documents, such as income verification and contractor plans.

- Accept the provided interest rate and loan terms.

- Submit extra documentation as required by the lender.

- Examine and sign the loan terms.

- If applicable, pay ahead closing costs.

- Receive funds using the agreed-upon payment method.

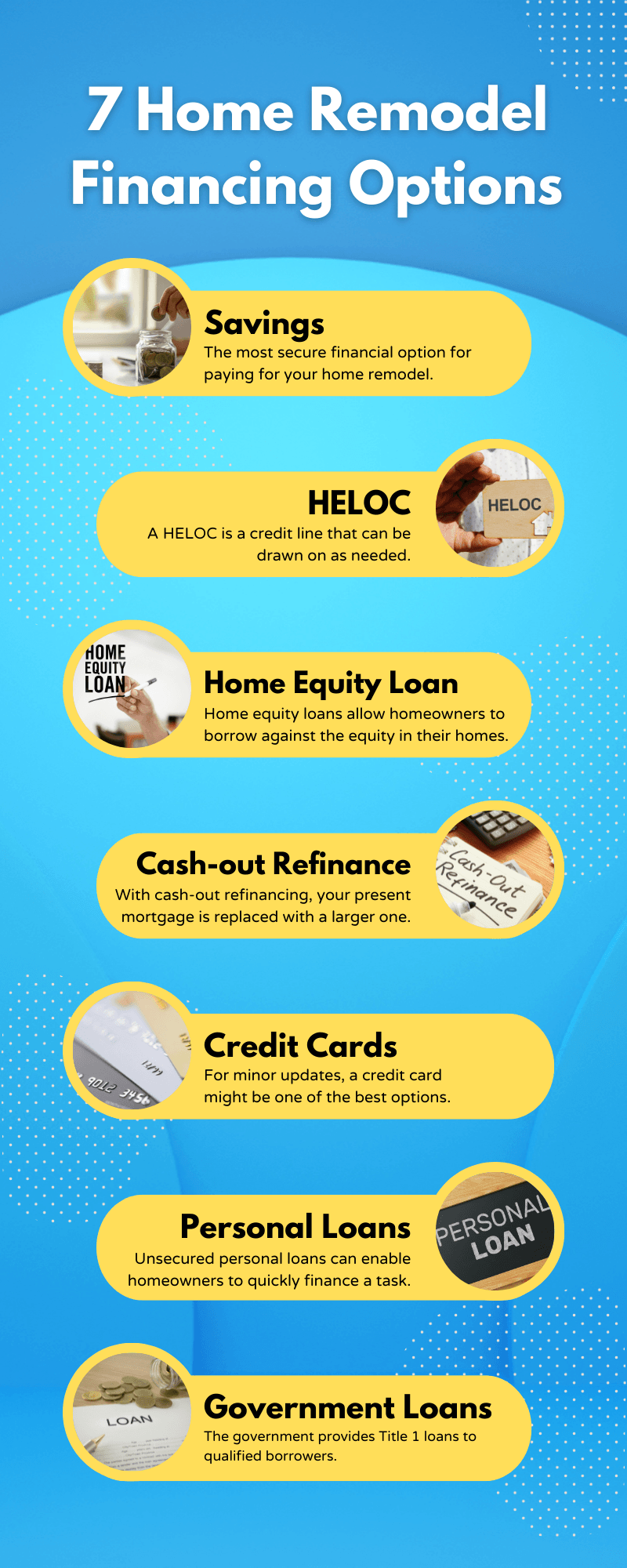

Home Remodel Financing Options