Home Remodel Financing Options

Home remodeling is a great effort, whether you are ready to sell your house or simply want a new look. One of the most important considerations when planning a home remodel is how to pay for it. It is critical to plan ahead of time on how to finance your home project to avoid additional costs and potential financial troubles. Here are some funding possibilities for house renovations.

1. Savings

The most secure financial option for paying for your home remodel is to set aside some funds for the project. If you don't already have a substantial sum of money saved up, this choice may require you to delay the commencement of your project. However, it also means you won't have to worry about repaying a loan or a huge credit card payment after completing your home remodeling.

2. Home Equity Line of Credit (HELOC)

A HELOC is a credit line that can be drawn on as needed. You only pay interest on the amount borrowed. HELOC levels can range up to 85 percent of your home's worth minus any mortgage debt you still owe.

Interest rates are frequently variable, and you normally have 10 years to use the money from a HELOC before repaying the balance. The ability to withdraw funds as needed makes a HELOC excellent if you don't know how much the remodeling will cost.

3. Home Equity Loan

Like a HELOC, a home equity loan enables you to borrow up to around 85 percent of your house's worth minus what you presently owe. The distinction is that you receive the cash in a single sum and repay them over a period of time that is often 15 years or fewer.

These loans frequently feature fixed interest rates and payments. Because home equity loans are completely funded at the outset, they are best used when you know the whole cost of your remodeling project.

4. Cash-out Refinance

With cash-out refinancing, your present mortgage is replaced with a larger one. The difference between the current mortgage debt and the new, larger loan is paid to you in cash, which you use to pay for your remodeling.

Cash-out refinancing is ideal if the new mortgage has a lower interest rate than your present loan and you require a significant loan for long-term home upgrades.

5. Credit Cards

Consider a 0 percent APR credit card for minor home upgrades that you can pay off during the interest-free period, typically 15 to 18 months. To qualify for these cards, you must have good or excellent credit (690 or above FICO).

Some credit cards offer rewards for specific purchases, such as home remodeling expenses. Credit cards can help you complete modest DIY or short-term projects that don't cost more than a few thousand dollars.

6. Personal Loans

Unsecured personal loans can enable homeowners to quickly finance a task. In contrast to home equity finance, which requires time-consuming underwriting and appraisal processes, most personal loan lenders promise funding within a week. Personal loan interest rates range from 6% to 36%, more than most home equity choices but lower than some credit cards.

Personal loans are great solutions for urgent repairs or projects that need to get started soon because they are funded quickly. If employing equity is not an option, they can also cover larger projects.

7. Government Loans

The government provides Title 1 loans to qualified borrowers who want to perform particular home improvements. For a single family home, you can borrow up to $25,000, with payback terms ranging from six months to twenty years.

Above $7,500, title 1 loans demand your home as collateral. You must also be a home resident for at least 90 days before you can borrow. If your project is eligible for this form of financing, it may be able to pay for the entire project or make it more reasonable.

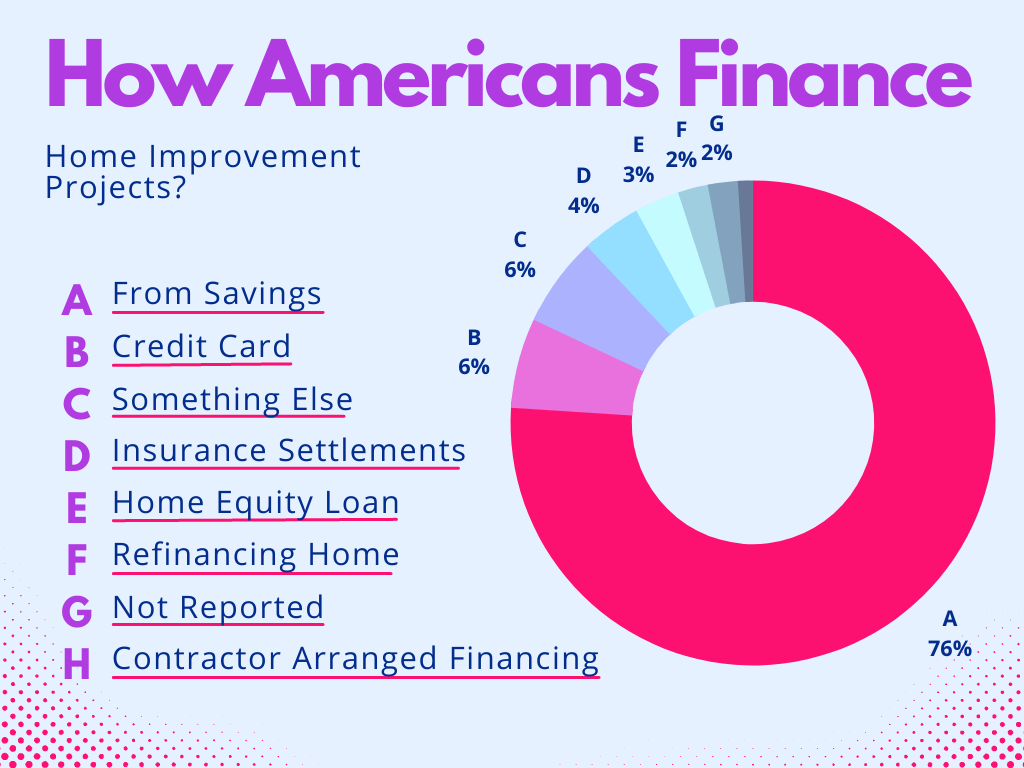

How Americans Finance Home Improvement Projects?